Merchants relying on Bank of America financial transactions often find themselves faced with a formidable adversary – chargebacks. These disputes, initiated by cardholders, can lead to revenue loss, operational challenges, and a dent in a merchant's reputation.

The complexity arises from the diverse reasons behind chargebacks, ranging from unauthorized transactions and billing errors to issues with goods or services received.

Identifying a robust solution to not only prevent but effectively manage chargebacks becomes paramount for businesses seeking financial stability and customer trust.

Understanding the multifaceted nature of chargebacks is the first step in crafting a strategic response. Merchants must know Bank of America chargeback reasons, varying time limits, and the impact on their bottom line.

ChargePay unravels the layers of Bank of America chargebacks, offering insights into the time-sensitive nature of disputes, the complexities of chargeback fees, and the overarching chargeback policy.

What is Bank of America Chargeback?

A Bank of America chargeback is a process that allows credit cardholders to dispute and reverse a transaction made on their Bank of America credit card. This often happens when customers believe they have been charged incorrectly or if they didn't authorize the transaction.

For merchants, it means dealing with the reversal of funds for a sale that was previously completed.

When a customer initiates a chargeback, Bank of America investigates the dispute to determine its legitimacy. Common reasons for chargebacks include unauthorized transactions, billing errors, or dissatisfaction with the product or service received.

Merchants should be aware that chargebacks can impact their bottom line and reputation. Businesses must understand the reasons behind chargebacks and take proactive steps to prevent them.

How does it work Bank on BOA policy?

The Bank of America chargeback process follows a structured series of steps that merchants should be familiar with:

- Initiation by the Cardholder: A Bank of America credit cardholder initiates a chargeback by contacting the bank and raising a dispute. This can happen for various reasons, including unauthorized transactions, incorrect billing, or dissatisfaction with the product or service.

- Bank Investigation: Bank of America then investigates the dispute by gathering information from both the cardholder and the merchant. This involves reviewing transaction details, receipts, and any communication between the parties.

- Merchant's Response: The merchant is notified of the chargeback and is allowed to respond. Merchants must provide clear and compelling evidence to support their case. This may include order confirmation, shipping details, or any relevant communication.

- Arbitration: If the initial investigation doesn't resolve the dispute, it may proceed to arbitration. An arbitration panel reviews the case and makes a final decision. Merchants need to actively participate in this stage to present their side of the story.

- Resolution: Based on the findings, Bank of America determines whether to uphold or reject the chargeback. If it is upheld, the funds are returned to the cardholder, and the merchant bears the loss. If rejected, the funds remain with the merchant.

Understanding this process is essential for merchants to effectively respond to chargebacks and increase the likelihood of a favorable resolution.

6 Common Reasons for Disputes

Merchants should be aware of the common reasons why Bank of America cardholders initiate disputes or chargebacks. Understanding these reasons can help businesses take preventive measures and address potential issues.

Here are some frequent causes:

1. Unauthorized Transactions

Customers may dispute charges if they did not authorize the transaction or if they suspect fraudulent activity on their account.

2. Billing Errors

Incorrect billing amounts, double charges, or other billing discrepancies can lead to disputes.

3. Product or Service Dissatisfaction

If customers are dissatisfied with the quality of a product or service received, they may resort to a chargeback.

4. Non-Delivery of Goods

Chargebacks can occur if customers claim they did not receive the purchased goods, whether due to shipping issues or other delivery-related problems.

5. Subscription Cancellations

Customers may forget to cancel subscriptions, leading to charges that they were not expecting.

6. Misrepresentation

If the product or service received differs significantly from what was described or advertised, customers may dispute the charge.

Merchants should address these common issues proactively by ensuring clear communication with customers, providing accurate product descriptions, and promptly resolving any concerns.

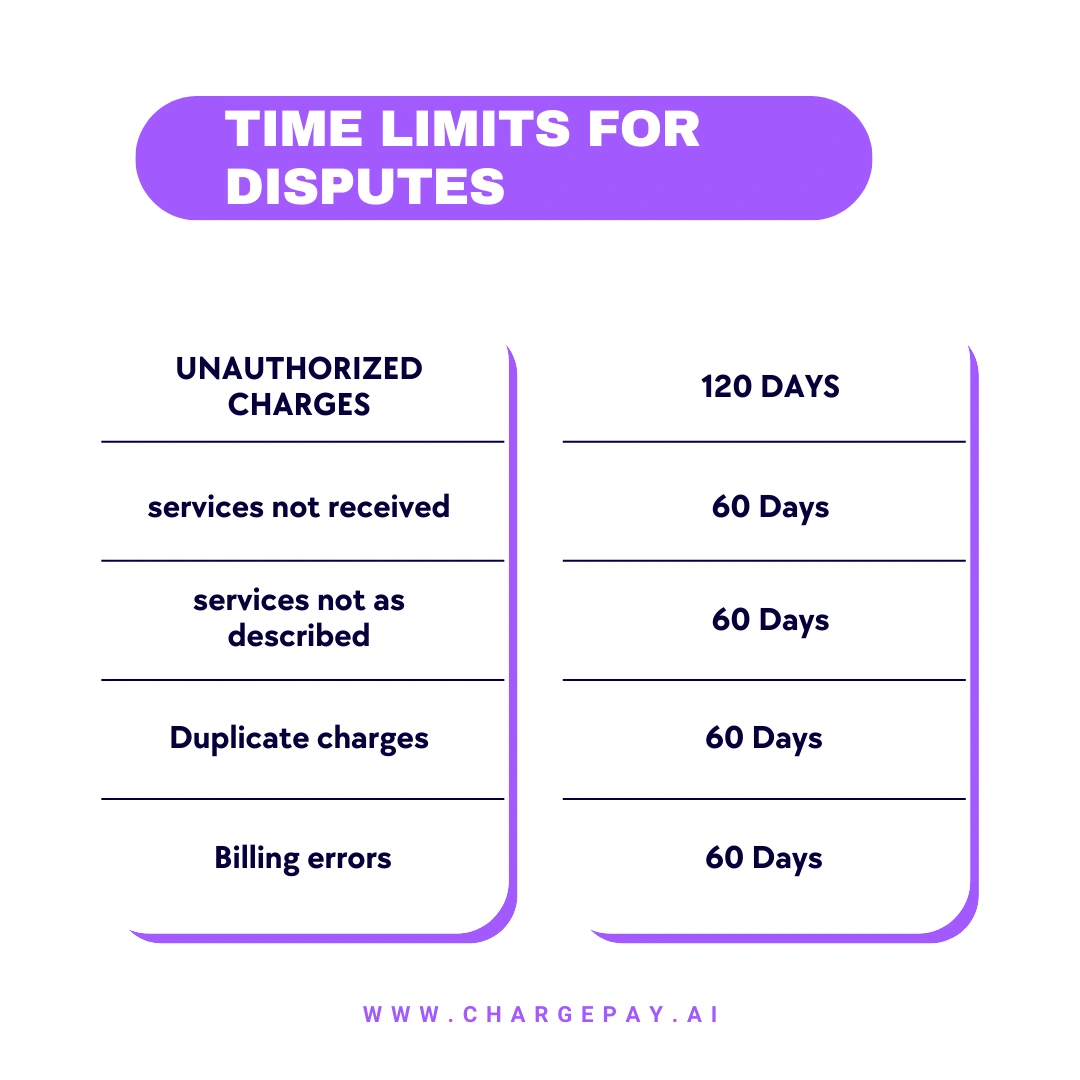

Bank of America Chargeback Time Limit

For Bank of America cardholders, the window to dispute charges on their credit card statement is set at 60 days from the date the transaction appears on the statement. Merchants must be aware of this timeframe, as it dictates the period during which a cardholder can initiate a chargeback.

Here are key details regarding Bank of America's chargeback time limit:

1. General Rule

The standard time limit is 60 days. During this period, cardholders can dispute charges for various reasons, including unauthorized transactions, billing errors, or dissatisfaction with the product or service.

2. Specific Exceptions

While the general rule is 60 days, there are specific exceptions with shorter time limits. For instance, if a cardholder suspects fraudulent activity on their card, they should contact Bank of America immediately, irrespective of the transaction date.

3. Statement Date vs. Transaction Date

It's essential to note that the time limit is based on the statement date, not the transaction date. This means that even if a transaction occurred more than 60 days ago, it may still be subject to dispute if it appears on a recent statement.

4. Consequences of Exceeding the Time Limit

If a cardholder fails to dispute a charge within the 60-day time limit, they may face challenges in recovering their money, even if the charge is deemed unauthorized.

Merchants should be proactive in addressing customer concerns and resolving issues within this timeframe to minimize the risk of chargebacks.

What is the Bank of America Chargeback Fee?

Bank of America imposes a chargeback fee on merchants, ranging from $25 to $50, for each disputed charge that undergoes the chargeback process. Merchants must be aware of this fee, as it adds to the overall cost associated with chargebacks.

Here are key points regarding the Bank of America chargeback fee:

1. Fee Range

The chargeback fee can vary within the range of $25 to $50. The exact amount depends on several factors, including the type of card involved. Premium cards may incur a higher chargeback fee.

2. Reason for Chargeback

The reason behind the chargeback can influence the fee amount. For instance, chargebacks related to fraud may have a different fee compared to other reasons.

3. Merchant's Chargeback History

Merchants with a higher history of chargebacks may face an increased fee. This is a consideration for businesses to maintain a low rate of chargebacks and address customer concerns promptly.

Merchants need to understand that the chargeback fee is only one aspect of the costs associated with chargebacks.

In addition to the fee, merchants may be responsible for covering the disputed transaction's cost and any other fees linked to the chargeback process.

Utilizing Bank of America Customer Service to Dispute Charges

If you find the need to dispute a charge on your Bank of America credit or debit card, the bank provides various convenient methods through its customer service. Here's a simple guide on how to initiate a dispute:

1. Phone

- For Credit Card Disputes: Dial 1-800-432-1000.

- For ATM or Debit Card Disputes: Call 1-877-366-1121.

2. Online

- Sign in to your Online Banking account.

- Locate the disputed transaction in your account activity.

- Click on the "Dispute this transaction" link.

- Follow the provided instructions to submit your dispute, and ensure to attach any supporting documentation.

3. Bank of America Mobile App

- Select the account containing the disputed transaction.

- Tap on the specific transaction and choose "Dispute Transaction."

- Follow the prompts to submit your dispute through the mobile app, and include any necessary supporting documentation.

4. Mail

- Send a written dispute letter to the address mentioned on your billing statement or the Bank of America website.

- Include the following details in your letter:

- Your name and account number.

- The date and amount of the disputed transaction.

- A brief explanation of why you are disputing the charge.

- Any supporting documentation, such as receipts or emails.

By utilizing these customer service channels, you can efficiently dispute charges with Bank of America, ensuring a streamlined resolution process. Choose the method that suits you best and follow the provided instructions for a hassle-free dispute experience.

13 Proactive Measures for BOA Chargeback Management

Effective Bank of America chargeback management goes beyond prevention and extends into proactive managerial steps to minimize risks and efficiently handle disputes. Here are unique measures for merchants to enhance their chargeback management:

1. Chargeback Analytics Dashboard

Implement a dedicated analytics dashboard to track and analyze chargeback trends. This can provide insights into specific product categories or transaction types prone to disputes.

2. Customized Communication Channels

Establish customized communication channels for customers with chargeback concerns. This can include a dedicated email or helpline, ensuring swift responses and resolution.

3. Customer Education Programs

Develop educational programs for customers during the purchase process. Communicate refund policies, transaction details, and terms to minimize misunderstandings that lead to chargebacks.

4. Proactive Customer Outreach

Regularly reach out to customers post-purchase to gather feedback. Identify and address potential issues before they escalate to chargebacks, demonstrating a commitment to customer satisfaction.

5. Chargeback Resolution Team

Create a specialized team within the organization dedicated to chargeback resolution. Their expertise can streamline communication with cardholders and improve the chances of resolving disputes in favor of the merchant.

6. Interactive Transaction Confirmations

Implement interactive transaction confirmations, allowing customers to confirm their purchases through email or SMS. This additional step adds a layer of authentication and reduces the likelihood of unauthorized dispute claims.

7. Automated Fraud Detection Systems

Utilize advanced fraud detection systems that automatically flag suspicious transactions. This proactive approach can help prevent chargebacks resulting from fraudulent activities.

8. Real-time Transaction Monitoring

Invest in real-time transaction monitoring tools to detect irregularities as transactions occur. Prompt alerts allow merchants to address potential issues swiftly.

9. Customized Dispute Resolution Portals

Develop a user-friendly online portal for customers to initiate disputes. A well-designed portal can guide customers through the process, reducing the likelihood of unnecessary chargebacks due to confusion.

10. Transaction Video Recording

Integrate transaction video recording for high-value purchases. This visual evidence can be crucial in resolving disputes by providing a clear record of the transaction.

11. Post-Refund Surveys

Implement post-refund surveys to understand the reasons behind customer refunds. This feedback can inform strategic decisions to minimize future chargebacks.

12. Chargeback Impact Assessments

Regularly assess the impact of chargebacks on the business. Understand the cost, frequency, and reasons behind chargebacks to refine strategies for better management.

13. Chargeback Root Cause Analysis

Conduct in-depth root cause analysis for chargebacks. Identify systemic issues and address them to prevent recurring disputes and enhance overall business processes.

These proactive measures go beyond traditional prevention tactics, emphasizing strategic approaches and continuous improvement in Bank of America chargeback management for merchants.

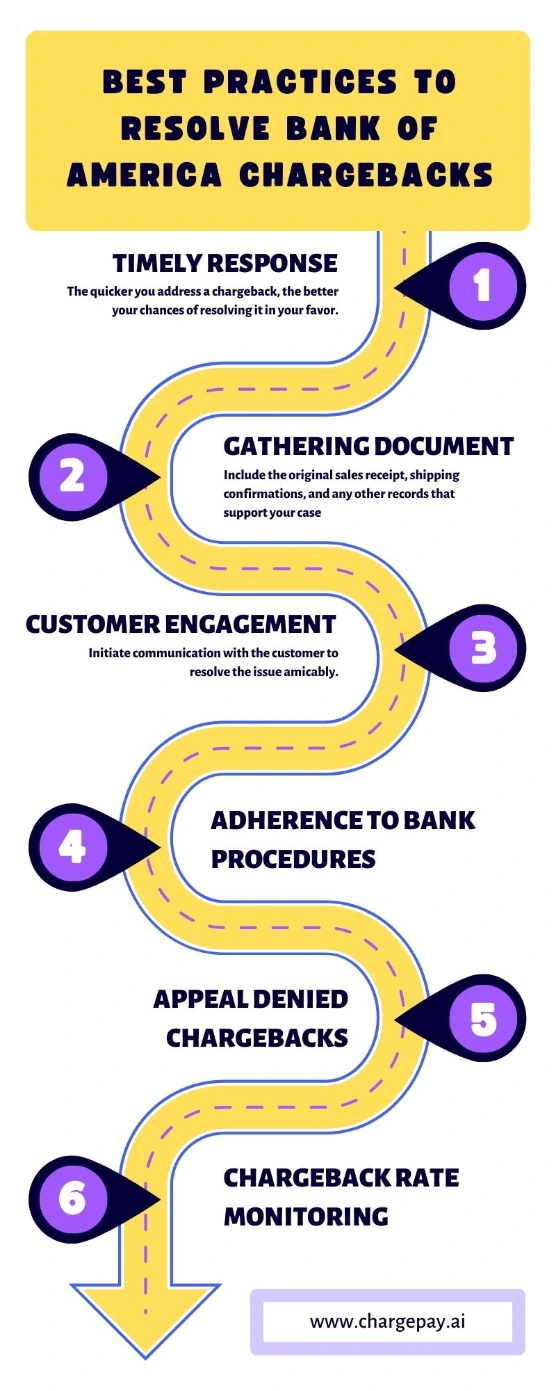

Merchant 8 Best Practices to Resolve Bank of America Chargebacks

Resolving Bank of America chargebacks requires a strategic and proactive approach from merchants. Here are eight best practices to effectively address and navigate the chargeback resolution process:

1. Prompt Communication

Respond swiftly to chargeback notifications. Open lines of communication with Bank of America and the cardholder promptly. Quick responses demonstrate a commitment to resolving the issue.

2. Thorough Documentation

Maintain comprehensive transaction records, including order confirmations, shipping details, and customer communications. These documents serve as crucial evidence during the chargeback resolution process.

3. Detailed Merchant Descriptions

Clearly describe your business on customer statements. A recognizable and accurate merchant descriptor can help prevent confusion and reduce the likelihood of chargebacks.

4. Customer-Focused Refund Policies

Establish transparent and customer-friendly refund policies. Communicate these policies during the purchase process to manage expectations and potentially prevent chargebacks.

5. Proactive Customer Service

Provide exceptional customer service by addressing concerns and resolving issues promptly. A satisfied customer is less likely to initiate a chargeback if their concerns are addressed effectively.

6. Chargeback Alerts and Notifications

Set up alerts and notifications for chargeback triggers. Proactively monitor transaction data to identify potential issues early on, allowing for swift resolution and prevention of future disputes.

7. Collaboration with Payment Processors

Work closely with payment processors to understand chargeback trends and implement effective solutions. Payment partners can provide valuable insights and tools to manage and prevent chargebacks.

8. Continuous Chargeback Analysis

Conduct regular analysis of chargeback data. Identify patterns, root causes, and trends to refine business practices, enhance fraud prevention measures, and minimize chargeback occurrences.

By incorporating these best practices into their chargeback resolution strategies, merchants can not only navigate the Bank of America chargeback process more effectively but also proactively reduce the occurrence of disputes.

Understanding the importance of communication, documentation, and continuous improvement is key to achieving positive outcomes in chargeback resolution.

Manage Chargebacks with ChargePay

ChargePay offers a revolutionary chargeback solution for managing and resolving chargebacks effortlessly.

With its AI technology, ChargePay automates the entire chargeback management process, providing merchants with an advanced tool to combat disputes and reclaim lost revenue.

The platform utilizes AI-driven representments, responding to chargebacks in real-time with generated defenses that significantly enhance the chances of winning.

A key highlight of ChargePay is its instant AI chargeback defense, fighting every new chargeback with the power of artificial intelligence.

The platform's proactive approach ensures swift responses and faster resolutions, eliminating the burden of manual effort for merchants.

By seamlessly integrating with leading payment processors such as PayPal, Shopify, and Stripe, ChargePay becomes a versatile and effective tool for businesses across various industries.

With the ability to win up to 3.5 times more chargebacks, recover over 80% of lost revenue, and identify and counter fraud automatically, ChargePay stands out as a powerful ally in the realm of chargeback management.

.webp)

.svg)

.svg)

.svg)

.svg)