eCommerce comes with its fair share of challenges, and one of the major financial challenges is dealing with chargebacks. As a merchant, you know that these customer disputes can lead to financial losses and administrative issues. Chargebacks happens for various reasons, including fraudulent transactions, customer disputes, or even the elusive "friendly fraud."

We're going to get into a solution that can make your life as a merchant a whole lot easier – choosing the right eCommerce chargeback protection service.

We'll break down the essential factors that will help you make a smart decision, and we'll introduce you to ChargePay, an advanced AI-driven chargeback management service that's designed with you in mind.

So, if you're tired of the high chargeback rate and revenue reduction, and want to protect your business and profits, keep reading. We're here to simplify the process and guide you toward the best choice for your online store.

Understanding the Need for Ecommerce Chargeback Protection

In the fast-paced world of e-commerce, chargebacks can be a real problem for online merchants like you. Before we get into how to tackle this issue, let's take a moment to understand why chargeback protection is essential for your business.

1. E-commerce Chargeback Statistics

To paint a clear picture, let's look at some eye-opening statistics:

- The average global e-commerce chargeback rate is 0.60%. This means that 6 out of every 1000 transactions will result in a chargeback.

- The average cost of a single chargeback is $190. This includes the chargeback fee assessed by the bank, as well as the lost revenue and other costs associated with the chargeback.

- Friendly fraud is now the number 1 source of e-commerce chargebacks, accounting for between 40% and 80% of all fraud losses. Friendly fraud occurs when a customer disputes a charge that they made, but for a fraudulent reason, such as claiming that they never received the goods or services, or that they were unauthorized.

- E-commerce businesses that sell digital goods and services tend to have higher chargeback rates than businesses that sell physical goods. This is because digital goods and services are more difficult to return and verify.

- The e-commerce industry is expected to lose over $49 billion to chargebacks in 2023.

- 40% of consumers who file a fraudulent chargeback will do it again within 60 days.

- 50% of consumers who file a fraudulent chargeback will do it again within 90 days.

- Merchants win only around 21% of all chargeback disputes.

- The average e-commerce merchant loses 1.8% of their total revenue to chargebacks.

Now, let's break down why these numbers matter to you.

2. Impact on Your Business

1. Financial Loss

Chargebacks aren't just a small hiccup; they can take a significant bite out of your revenue. With an average cost of $190 per chargeback, it doesn't take many chargebacks to eat into your profits.

2. Fraud Prevalence

The rise in friendly fraud is alarming. Customers disputing legitimate charges for fraudulent reasons can hit your bottom line hard. You don't want your hard-earned money falling into the wrong hands.

3. Product Types

If you're in the business of selling digital goods and services, you're at a higher risk. With chargeback rates generally higher in this sector, you need a robust protection plan.

4. Long-term Impact

The recurring nature of fraudulent chargebacks is concerning. If you don't address the issue effectively, it can become a chronic problem, affecting your business over time.

5. Dispute Success

Winning chargeback disputes isn't a cakewalk. Merchants succeed in only about 21% of cases. You need to be well-prepared to protect your business.

6. Revenue Erosion

The 1.8% of total revenue lost to chargebacks can be a substantial sum. Think about what you could do with that money if it wasn't slipping away.

Chargebacks are a lurking threat to your e-commerce business. You can't afford to ignore them. Understanding the impact they can have on your finances and the long-term sustainability of your business is the first step in making sure you're protected.

5 Key Considerations in Choosing an Ecommerce Chargeback Protection Service

In the world of online business, chargebacks can be a headache. They're part of the deal, but how you handle them matters. So, when picking the right chargeback protection service for your online store, there are five important things to think about.

These things can help you save money, keep your customers satisfied, and steer clear of chargeback hassles. Let's break down these essential factors to help you make a smart choice.

1. ROI (Return on Investment)

ROI (Return on Investment) is a big deal when you're picking a chargeback protection service for your online store. It's all about making sure you get more money back than you put in.

Here's the chargeback situation in Perspective: chargebacks can reduce your business profit margins significantly as we discussed in the earlier section. They can decrease your profits and leave you in a tough spot with high chargeback rates.

A good chargeback protection service should make financial sense. Ideally, for every dollar you spend on it, you want to get at least three dollars back. That's a 3X ROI, and it's the goal you should aim for.

Here's why ROI matters:

- More Profits: Your online store is about making money. Chargeback protection should help you keep more of the money you make.

- Cutting Losses: Chargebacks cost you money – the disputed amount, fees, and lost products. A good chargeback protection service should stop some of these losses, which means more cash in your pocket.

- Saving Time: Dealing with chargebacks takes time and effort. An efficient chargeback protection service can save you time and help you focus on growing your business.

So, when you're choosing a chargeback protection service, remember to think about the ROI. If it's not promising to at least triple your investment in savings and recovered money, it might not be the right choice for your online store. Keep it simple, make more money.

2. Customer Support

For choosing the right ecommerce chargeback protection service for your online store, a few features matter a lot. One of those features is Customer Support.

It's not just a nice-to-have; it's a must-have for merchants like you. So, let's get into why good Customer Support can be your lifeline in the world of chargebacks.

Customer Support is like your safety net:

- Help When You Need It: When you're in a tight spot with a chargeback, you want to know that there's someone you can reach out to for help. A chargeback protection service should have a team that's ready to assist you when you need it.

- Answers to Your Questions: Sometimes, chargebacks can be a bit confusing. You might not be sure what to do. Good customer support means you can ask questions and get clear answers. No fancy jargon, just simple, easy-to-understand solutions.

- Peace of Mind: Knowing there's a friendly voice at the other end of the line can give you peace of mind. You're not alone in this.

When you're looking for a chargeback protection service, remember that good Customer Support is like your trusty support. It's there to help you out when ecommerce chargeback disputes happen in your store. Simple and friendly support is what you need to make your life easier as an online store owner.

3. Case Studies

Now, let's discuss something super important – Case Studies. These aren't boring reports; they're like real-life stories about how businesses handled chargebacks with a specific protection service. It's like your friend telling you, "Hey, I tried this, and it worked."

Why Case Studies Matter:

- Real-Life Success Stories: Case studies show how real businesses dealt with chargebacks. It's like getting insider tips from people who've been in your shoes.

- Trustworthy Proof: When a chargeback protection service shares case studies, it means they believe in what they do. They're saying, "Check out how we helped these businesses." It's a sign you can trust.

- Seeing Is Believing: Reading about how others turned the tables on chargebacks helps you see what's possible. It's not just words; it's actual results.

In the chargeback world, case studies are like your backstage pass. They show you what works and what you can trust. It's not complicated – it's proof that makes your decisions easier for your online store.

4. Time Saving

When it comes to your eCommerce business, every minute counts. The time you spend dealing with chargebacks can eat into your productivity and profits. That's why choosing the right chargeback protection service is essential.

1. Automation is Your Time-Saving Ally

One key way to save time is through automation. Many chargeback protection services offer automated processes that handle the nitty-gritty work for you. Instead of manually sifting through transaction records and gathering evidence, these services use AI to streamline the process. That means less time spent on paperwork and more time focused on growing your business.

2. Quick Issue Resolution

Time is money, and this is especially true when it comes to chargebacks. The longer a chargeback case lingers, the more it can impact your bottom line. A good chargeback protection service can help resolve disputes swiftly. They have the experience and knowledge to navigate the chargeback process efficiently, ensuring a faster resolution.

3. Fewer Manual Tasks

With the right service, you'll find yourself doing less of the manual labor associated with chargebacks. Whether it's gathering evidence, filling out forms, or communicating with banks, a quality chargeback protection service takes these tasks off your plate, giving you more time to focus on what you do best – running your business.

4. Proactive Monitoring

Time-saving doesn't just mean dealing with chargebacks when they happen. It's also about preventing them in the first place. Some chargeback protection services offer proactive monitoring, alerting you to potential issues before they become chargebacks. This early warning system can save you time and money in the long run.

5. Cost

When you're finalizing a chargeback protection service for your online store, one big factor on your mind is cost.

First off, what's the damage if you don't get any protection? You lose the money from the sale, and there's a chargeback fee as well. Now, you have to calculate the time and manpower it takes to fight these chargebacks – that's hours and hours you could spend growing your business. So, not having protection can cost you a lot.

The cost of chargeback protection services can vary. Some charge per transaction, some charge a flat fee, and some take a cut of what they recover for you. It's important to do the math and figure out which one suits your business best.

If you're worried about high chargeback rates, the cost of a good protection service is nothing compared to what you're losing. It's an investment in keeping your hard-earned money where it belongs – in your bank account.

So, don't let the cost scare you away from ecommerce chargeback protection. Look at it as a wise business move. And that's a smart money play.

Evaluating ChargePay as Your eCommerce Chargeback Management Solution

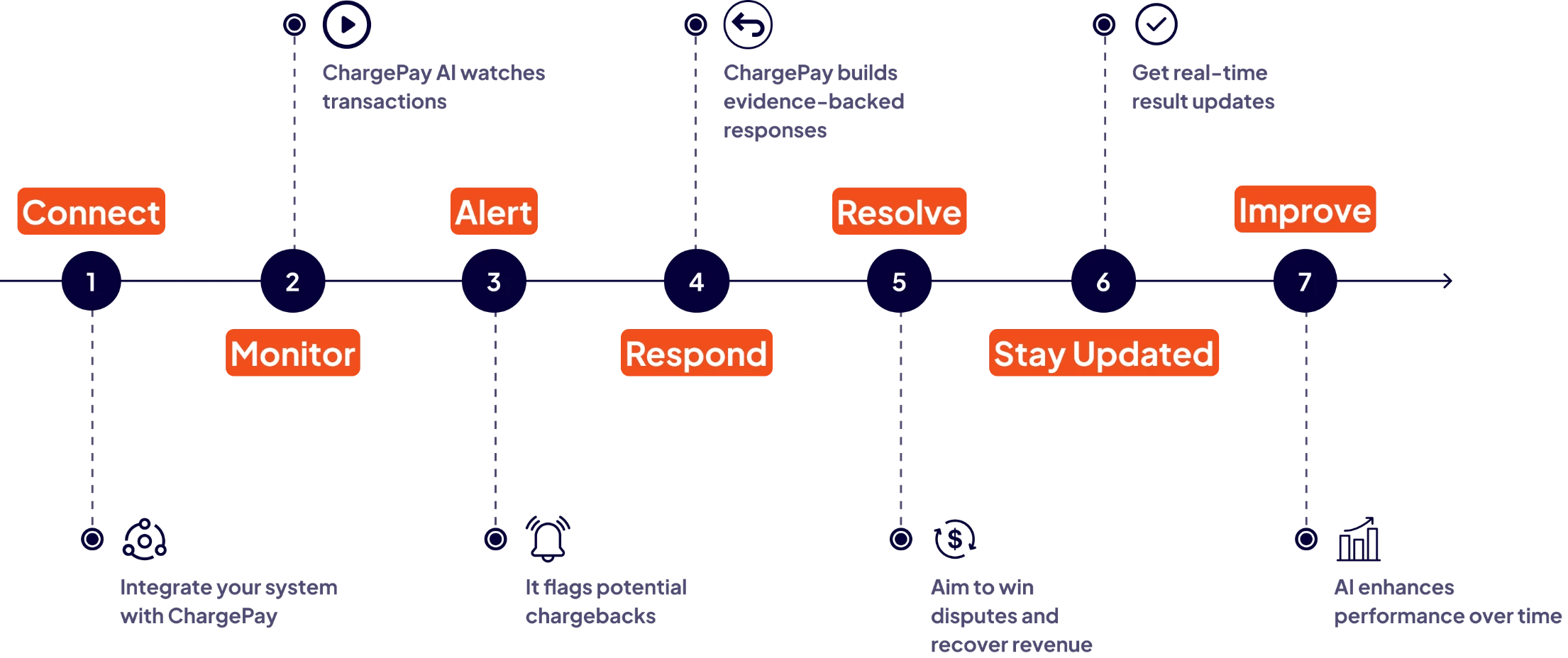

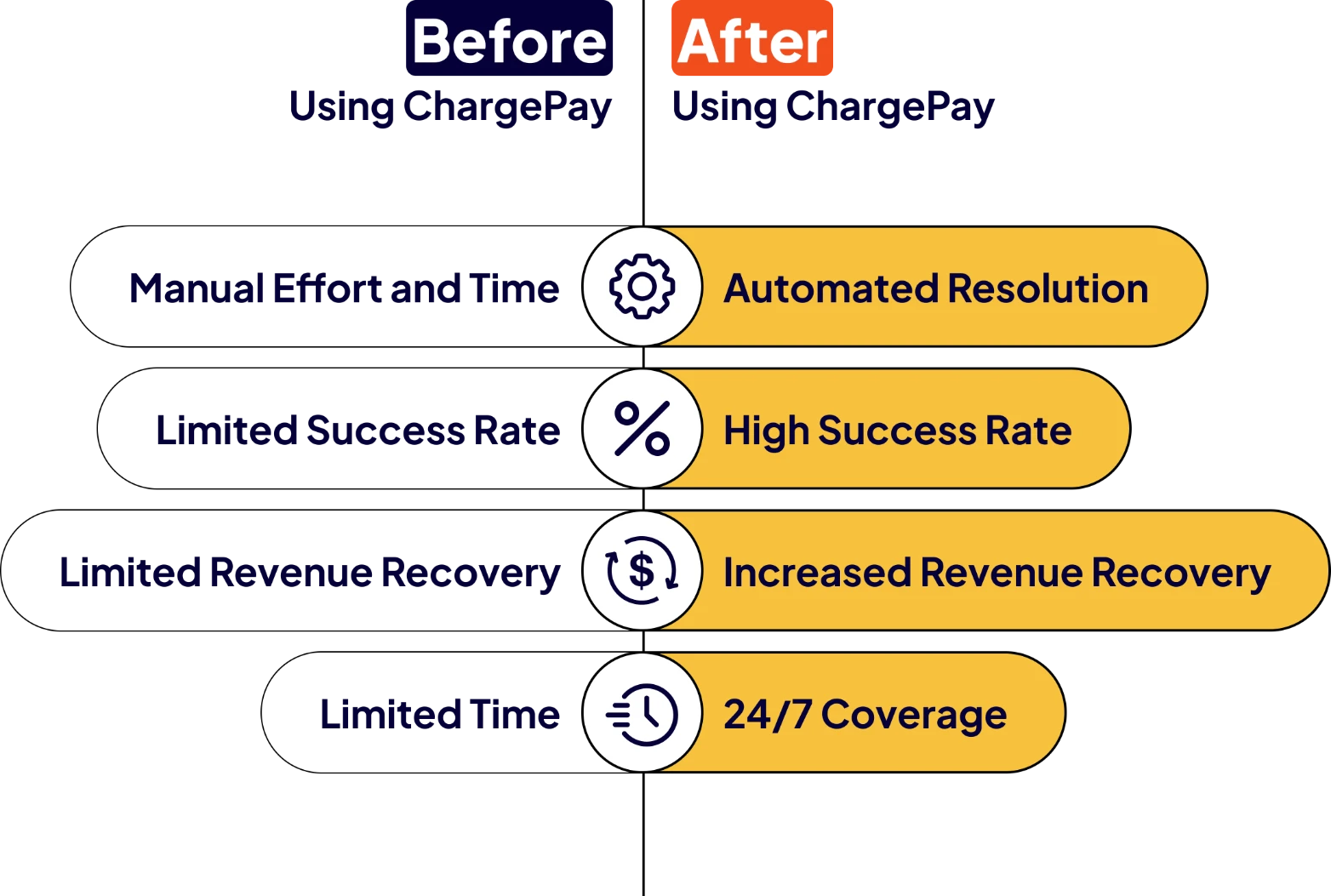

eCommerce merchant looking to safeguard your business against chargebacks, ChargePay is a solution worth considering. ChargePay is an AI-powered chargeback management system that can help you automatically contest and win chargebacks without the hassle of manual efforts. Here's why you should evaluate ChargePay as your chargeback protection solution:

1. AI Representments for Winning Chargebacks

ChargePay leverages artificial intelligence to create winning representments for new chargebacks. It means that when a chargeback occurs, ChargePay responds with an auto-generated representment designed to increase your chances of winning the dispute.

2. Real-Time Response for Faster Resolution

Time is of the essence when dealing with chargebacks. ChargePay responds to chargebacks in real time, allowing you to resolve issues faster and avoid revenue losses. This rapid response can be critical in retaining your hard-earned money.

3. Incredible Win-Rate and Revenue Recovery

ChargePay boasts an impressive win rate, helping you win a record number of chargebacks. You can recover up to 80% of the revenue you may have previously lost due to chargebacks. This means more money in your pocket and less worry about disputes.

4. Seamless Integration with Leading Payment Providers

ChargePay is compatible with popular eCommerce platforms such as Shopify, PayPal, Stripe, and more than 30 leading payment processing providers. This seamless integration ensures that ChargePay can work alongside your existing setup.

5. AI Counter Fraud for Protecting Your Business

ChargePay's AI continually learns to identify chargeback fraud, countering fraudulent claims automatically. This proactive approach safeguards your business and minimizes the impact of fraudulent chargebacks.

6. Chargeback Workflow Automation

With ChargePay, you can automate your chargeback workflow, making the process hands-free and efficient. It helps you reclaim over 80% of revenue lost to chargebacks, all while boosting your reputation with payment providers and customers.

7. Integrate with Any Payment Provider

Whether you're using PayPal, Shopify, Stripe, or another leading payment processor, ChargePay integrates seamlessly with over 30 payment providers, making it adaptable to your payment setup.

8. Smart Dashboard for Easy Management

ChargePay provides a user-friendly dashboard that tracks and manages chargebacks with ease. This intuitive interface simplifies the chargeback management process, allowing you to focus on your core business operations.

9. Boost Brand Trust and Reputation

As you successfully contest and win chargebacks with ChargePay, your brand's reputation will grow with payment providers and customers. This enhanced trust can lead to smoother transactions and long-term customer relationships.

10. Proven Results and Customer Testimonials

ChargePay is trusted by businesses, with customers experiencing incredible results. These results include a 3x chargeback win-rate increase and a 68% boost in saved revenue.

Ready to protect your eCommerce business from chargeback losses and grow your revenue effortlessly? Choose ChargePay as your trusted chargeback protection solution today.

With our AI-powered technology, you can boost your chargeback win rate, recover lost revenue, and enhance your brand reputation without breaking a sweat.

Don't wait for more chargebacks to eat into your profits. Contact the ChargePay team now to get started. Our experts are ready to answer any questions you may have and guide you through the process of implementing eCommerce chargeback management. Get in touch with us today!

.svg)

.svg)

.svg)

.svg)